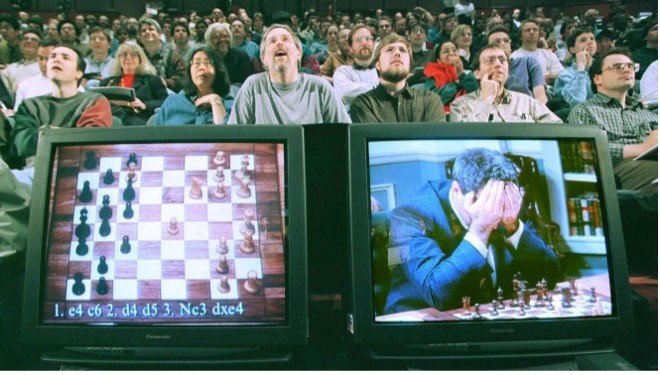

Deep Blue versus Garry Kasparov: Deep Blue versus Garry Kasparov was a pair of six-game chess matches between the world chess champion Garry Kasparov and an IBM supercomputer called Deep Blue. The first match was played in Philadelphia in 1996 and won by Kasparov (4 – 2). The second was played in New York City in 1997 and won by Deep Blue (3.5 – 2.5). The 1997 match was the first defeat of a reigning world chess champion by a computer under tournament conditions.[1]

Introduction

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This type of trading attempts to leverage the speed and computational resources of computers relative to human traders. Algorithmic Trading is also bereft of human emotions which usually account for the reason of losses in the market. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. [2]

With Indian regulators observing and categorising the API-based trades under Algorithmic trading, it is important to be aware of the risk controls that exist in case of mishaps and flash crashes.

“… spends tens of millions of dollars on this stuff … They have more people working in their technology area than people on the trading desk…The nature of the markets has changed dramatically.” [3]

Artificial Intelligence VS Algorithmic Trading:

Artificial intelligence is the simulation of human intelligence processes by machines, especially computer systems [4]. Given the fact that Artificial intelligence has stepped into almost all walks of life, the legal domain is no exception.

There are numerous, real-world applications of Artificial intelligence systems today. Algorithmic trading is one example of Artificial intelligence.

“A sea change is happening in finance. Machines appear to be on the rise and humans on the decline. Human endeavors have become unmanned endeavors. Human thought and human deliberation have been replaced by computerized analysis and mathematical models. Technological advances have made finance faster, larger, more global, more interconnected, and less human. Modern finance is becoming an industry in which the main players are no longer entirely human.” [5]

The volatility and nature of the markets are also open to discussion because of the maturity because of Algorithmic trading.[6]

What is an Algorithmic Trading Developer and a Quantitative Developer?

An Algorithmic Trading Developer is the one who designs algorithms for generating trading signals as well as for placing orders. The decision to buy or sell is based on the computations performed by the algorithm with the help of the information.

A Quantitative Developer is knowledgeable in subjects such as mathematics, advanced finance, algorithms, and data structures. A Quantitative Developer uses complex mathematical computations and quantitative analysis so as to create algorithms for trading.

“Algorithmic Trading enables us to inculcate discipline into our trading with less effort. Thanks to its statistical nature, it takes away the fear of losing a lot of money and the greed of earning money out of proportions. It helps us all become more disciplined and systematic, which in turn helps us grow our wealth consistently. As Algorithmic Trading penetrates the Indian Markets more, it will help ameliorate people’s opinion towards the stock market. People will begin realising that the stock market is not a ‘gambler’s paradise’ but a risk instrument to invest our savings in.” Mr. Chirag Pangoriya, Founder and CEO of Able Algorithmic Technologies.

Using Algorithmic Trading has many advantages, like an effective and efficient system that enables users to focus more on value-added work. But advanced Algorithmic trading has certain challenges that require our attention:

DATA PRIVACY: Privacy concerns regarding the collection, use, and storage of personal data by Algorithmic trading systems and the exploitation of personal information of clients without knowledge and approval.

CYBER THREAT: There is a higher risk of cyber threats as such Algorithmic trading can be easily hacked or stolen. Also can Algorithmic trading systems hack and steal from other Algorithmic trading systems and/or traders?

MARKET MANIPULATION: As Algorithmic Trading can assist placing thousands of orders within seconds, this can be used to create fake volumes in the market.

LACK OF PROPER SYSTEM: QUALITY ASSURANCE; A machine cannot function effectively unless a large chunk of reliable data is provided to it. Bad data or legally incorrect decisions or lack of structured data will reduce the quality of the result Algorithmic trading. Who checks?

DAMAGE: Minor mistake or malfunction of Algorithmic trading software can cause irreversible damage.

LACK OF LEGAL FRAMEWORK: What is the legal status of robots or machines or high-level advanced Algorithmic trading. What kind of punishment can be attributed to Artificial Intelligence and Computer Systems?

ETHICAL CONCERN: It lacks originality, creativity, and innovative skills. The personal bias of the creator can also impact its function and output of the Algorithmic trading.

Never Say Never Again:

Even in markets like India, Hong Kong, Singapore and other emerging markets the Algorithmic trading used by retail traders has grown considerably. Regulators are coming to terms that it is important to implement a proper quality and legal framework, where algorithmic trading can playing an important role and allow better informed financial decisions. This in turn can help economies and markets become more mature. It is important for users and developers to apply appropriate due diligence and risk measures.

For further information on Algorithmic Trading and Quantitate Trading as well as its application in Law please contact Mr. Nitin Walia at business@tuskh.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances

- Source [1] Deep Blue versus Garry Kasparov Available at: https://en.wikipedia.org/wiki/Deep_Blue_versus_Garry_Kasparov

- Source [2] Lin, Tom C. W., The New Investor. 60 UCLA Law Review 678 (2013), Temple University Legal Studies Research Paper No. 2013-45, Available at SSRN: https://ssrn.com/abstract=2227498

- Source [3] Citigroup to buy electronic trader, Available at: http://archive.boston.com/business/globe/articles/2007/07/03/citigroup_to_buy_electronic_trader/

- Source [4] IBM Cloud Learn Hub What is Artificial Intelligence (AI)?, Available at: https://www.ibm.com/cloud/learn/what-is-artificial-intelligence

- Source [5] Lin, Tom C. W., The New Investor. 60 UCLA Law Review 678 (2013), Temple University Legal Studies Research Paper No. 2013-45, Available at SSRN: https://ssrn.com/abstract=2227498

- Source [6] Volatility: how ‘algos’ changed the rhythm of the market. Available at: https://www.ft.com/content/fdc1c064-1142-11e9-a581-4ff78404524e